Welcome to Deanbridge International’s community of Family Investment Companies

Unique Data Analysis

Practical Business Intelligence

Facilitated Peer-to-Peer Networking

Join our growing community of like-minded,

multi-generational families-in-business to network, learn and share.

Project leaders:

John Learmonth & Professor Heinrich Liechtenstein

In association with:

THE PROJECT

Family Investment Companies – recognising an important community of family enterprises

THE PROJECT

Family Investment Companies – recognising an important community of family enterprises

The Evolution of Family Businesses

In our 20 years working with family businesses, we would occasionally encounter an enterprise that differed from others.

These are families who evolved, often long ago, beyond the founder’s heritage business and who now actively manage a portfolio of companies and assets.

Attributes in Common

Despite different origins, these family enterprises have similarities. They are structured and run as companies. They are active investors and managers of a range of companies and assets. They draw heavily on their family’s heritage and history to frame their response to current change and future challenges. And their ultimate goal is to perpetuate the family, its values and its business.

We named these enterprises Family Investment Companies (FICs), defined as:

‘A family-owned or controlled company actively investing directly in and managing a portfolio of businesses and assets.’

And then we set out to find out more about them, what they needed and how we might serve them.

Unique Data Analysis

Finding out who they are and what they do

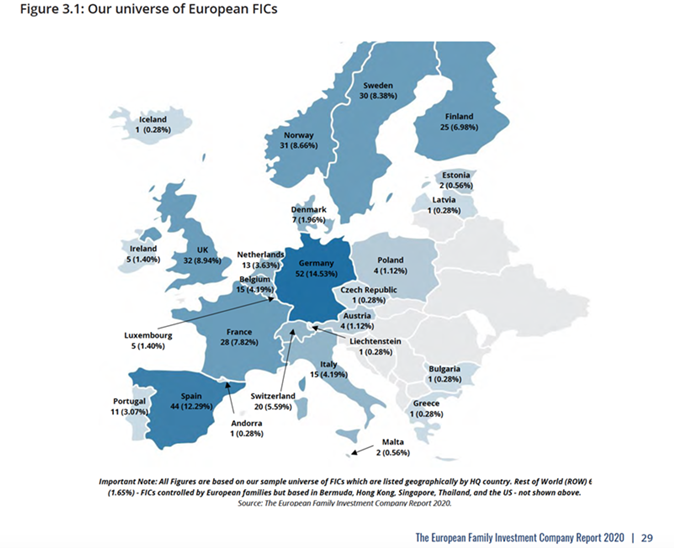

We built a proprietary database, initially concentrating on European FICs, by spending hundreds of hours talking with families and researching their investment companies.

To date we have identified over 400 FICs and captured a broad range of information about them, their families, heritage businesses and current investments. This data and analysis are presented in our cornerstone, regularly updated Report illustrated by 100+ real-life experience and ‘war stories’ from named FICs, in addition to more detailed Conversations with FIC family leaders.

Practical Intelligence

When your FIC subscribes to Deanbridge International’s community of Family Investment Companies you gain instant access to original data and insights and most importantly, practical intel you can apply immediately to your own family enterprise.

In addition to the Report, subscribers can instantly take advantage of a one-to-one conversation with a Project Leader to take a deeper dive into Report topics of their choosing.

Regular EFIC News Briefings, which track and interpret the real-time actions of named FICs, will be delivered regularly by email.

We understand that subscribers will continue to have questions and to meet this demand, the Deanbridge team will be available for continuing, reasonable email dialogue during the subscription term.

Bespoke research specific to your FIC’s needs may also be commissioned. Terms on request.

Facilitated Networking

Unique and specific practical demands from a unique and specific community of families-in-business

Family Investment Companies need answers to questions other corporate entities rarely have to ask. How to maintain family ‘glue’ around a diverse and changing portfolio of assets? How to find great, long-term investments? How to grow entrepreneurship in ‘new’ sectors such as digital disruption and renewable energy? How to hire, remunerate and retain excellent non-family executives? How to locate like-minded co-investors? How to secure and work with external capital?

Members of our community can leverage the benefits we provide to find potential answers to these questions.

Building a community

An example of practical, beneficial facilitated networking occurred during the COVID-19 pandemic. Deanbridge International began offering regular news updates to subscribers, which grew into Zoom meetings, which led to offline introductions and conversations.

We found we had created a trusted community and a reliable channel of communication, This allowed FIC families – whether suffering or benefiting from the pandemic – to shorten their learning curves during the unprecedented circumstances by learning and sharing with their peers.

We are able to make direct introductions between FICs who want to meet to discuss specific family challenges, co-investments or areas of business collaboration.

Unique Benefits

The unique benefits we offer are attracting growing support from families across Europe, as well as the Middle East and South-East Asia. Current community members range in generation from third to ninth, and in total assets size from €25 million to over €14 billion.

WHY

Peer-to-Peer

Families-in-business need the package of practical benefits available to our community, especially in times of crisis. Despite the current, challenging business environment, our community is attracting increasing support from FICs in Europe and around the world who recognise its importance and value as they plan for their future.

Here are some of the practical reasons major FICs are joining our community:

Networking

Family group transitioning into formal holding structure sought dialogue with other FICs who had already been through the process, as well as input on practical issues such as board composition and liquid investing.

Multi-business FIC, Middle East

Investing

Following the sale of a major portfolio business, a strategy to re-invest in a new direction was required as well as a desire to speak with FICs with existing sector knowledge, or who might be potential co-investment partners.

Liquidity-event FIC, UK

Benchmarking

Sensed that they were doing the right thing but knew they could always learn from others in areas such as investment strategy, identifying target sectors, team building, organisation structures and involving family members.

Private FIC, Belgium

Connecting

The investment arm of a multi-generational family made direct, one-on-one introductions to other FICs active in their specific target investment sector to discuss co-investment and partnership opportunities.

FIC investment arm, UK

Succession

Using examples from other FICs to inform generational transition and educate the NextGen, focussing on specific issues such as board composition, leadership, communication and gender balance.

Multi-generational FIC, SE Asia.

Structures

Learning how families use different classes and types of shares to control listed FICs, also seeking data and insights to inform governance revision for NextGen as well as how other FICs frame, communicate and transmit values.

€1+ billion revenue FIC, Germany

Learning

An additional education and intelligence resource to assist family shareholders with strategy oversight and renewal, especially in areas such as values, leadership and governance.

Listed FIC, France

Governance

Data, insight and examples needed to upgrade a strategic plan for a group overhaul, reviewing governance and succession mechanisms, benchmarking against other FICs to aid family buy-in.

Diversifying FIC, UK

Strategy

Examples and data from other families to complement a family wealth strategic review linked to a generational transition, examining specific issues such as communication, impact investing and fostering entrepreneurship in the NextGen.

Industrial FIC, Spain

Families Learning From Families

If you are a family-in-business setting out on the path to become a FIC by diversifying and restructuring, then you will have much to learn of practical value from families who have been FICs for many generation. New FICs always want to become old ones!

TESTIMONIALS

I really like the approach and structure of the Report – the real-life family histories and standouts blend in very well with its data and analysis’s.

Simone Møkster

Managing Director, Family Business Norway; 2nd generation family business owner; member of the Polaris Committee, FBN International.

The European Family Investment Company Report is a great initiative and addresses a topic of interest to more family businesses than one would think. The Report is very well documented, with a lot of valuable information and analysis. Moreover, associated activities, such as News Briefings and Virtual Conversations, organised by Deanbridge are adding value by nurturing exchanges between FICs.

Professor Christine Blondel

INSEAD, France; former non-executive Director, D’leteren, Belgium.

The named examples in the Report about what other families are actually doing in practice, allow us to benchmark and give us comfort we’re doing the right thing.

Alexander Scott

Former Chairman and 4th generation family shareholder, Applerigg, UK; Treasurer, FBN International.

I am very pleased to support The European Family Investment company Report which contains much value for family businesses seeking an entrepreneurial and sustainable future.

Alfonso Libano Daurella

Co-Vice Chairman and 3rd generation family shareholder, Cobega, Spain; Chair of the Polaris Committee and member of the Ambassadors’ Circle, FBN International; Circle of Friends, European Family Businesses.

John Learmonth and Heinrich Liechtenstein are opening up a knowledge gap – this Report is recommended to all entrepreneurial families who do not want to put all their eggs in one basket.

Dr Rena Haftlmeier-Seiffert

Managing Director, EQUA Stiftung, Germany.

‘The Report’s unique knowledge and insights, presented in a most practical and readable way, have helped us see what other families are doing – like all family businesses we are constantly evolving and have, I think, a duty to educate ourselves. We also find of real, additional value the opportunities Deanbridge has given us to connect directly with other family investment companies, such as by participating in their Virtual Conversations, for networking and learning in a relaxed setting.’

Johannes Gullichsen

Chairman of the Board of Directors and 5th generation family shareholder, Antti Ahlström Perilliset, Finland.

Community Benchmarking

A growing community of family enterprises is already taking advantage of the benefits we offer – learning about new developments and strategies directly from their peers as well as from our unique data and practical intelligence.

THE BENEFITS

Subscribers to our community enjoy an impressive list of practical benefits.

- Copies of the unique and groundbreaking European Family Investment Company Report delivering practical, proprietary data and analysis of the FIC universe, with over 100 named examples, supplemented with in-depth interviews with family leaders from multi-generational FICs who share real life experience and ‘war stories’.

- All additional supplements not privately commissioned.

- A follow-up one-hour in-depth briefing with one of our project leaders to take a deep-dive into topics from the Report, or any of our other materials of your choosing.

- Invitations to attend our private peer-to-peer Virtual Conversations and Roundtables to discuss the practical business, investment and family issues FICs face today.

- Opportunity to book to attend physical meetings.

- Receipt of our regular EFIC News Briefings which track and interpret the real-time actions of named FICs.

- Facilitated networking via one-on-one introductions as well as in our Virtual Conversations.

- Opportunity to request us to organise a ‘bespoke’ Virtual Meeting, bringing together a group of FICs to discuss an issue a community member specifically wants to address (currently at beta stage).

- Ability to commission specific research (additional fees apply).

- Team leaders’ availability for reasonable continuing dialogue.

Making Connections

FICs in ‘new’, fast-growth economies will have much to gain from talking to FIC families in ‘old’ economies, and vice versa.

Make valuable connections in our community.

THE TEAM

Credibility, expertise, experience

Deanbridge International

The European Family Investment Company Report is published by Deanbridge International (Deanbridge Advisors International Limited), founded by John Learmonth to provide data, intelligence and networking for FICs, family businesses and their advisors.

IESE Business School

The European Family Investment Company Report is published in association with IESE Business School. IESE is the graduate business school of the University of Navarra. It has been at the forefront of management education for 60 years. It provides diverse programmes and courses to develop and inspire present and future business leaders who strive to make a deep, positive and lasting impact on the people, companies and society they serve.

Deanbridge International

The European Family Investment Company Report is published by Deanbridge International (Deanbridge Advisors International Limited), founded by John Learmonth to provide intelligence and research for FICs, family businesses and their advisors.

IESE Business School

The European Family Investment Company Report is published in association with IESE Business School. IESE is the graduate business school of the University of Navarra. It has been at the forefront of management education for 60 years. It provides diverse programmes and courses to develop and inspire present and future business leaders who strive to make a deep, positive and lasting impact on the people, companies and society they serve.

John Learmonth

The Report is written by John Learmonth who has worked with significant business families for over twenty years. He founded Campden Publishing and built it into a leading, global media group in the areas of healthcare and private wealth management. As part of the latter he organised the first conference in Europe for family offices as well as pioneering its provision of conferences and information for family businesses, FICs, significant private investors and their advisors both in Europe and in Asia. During this time, he worked closely with the Family Business Network (FBN) and many individual country family business associations, serving on the Advisory Council of the UK Institute for Family Business (IFB). Since selling Campden he has been engaged in various projects including participating in turnarounds, advising a merchant bank and a family-owned investment holding company. He is a graduate of Gonville and Caius College, Cambridge.

Professor Heinrich Liechtenstein

The Report is written with Heinrich Liechtenstein who is Professor of Financial Management at IESE where he lectures in the MBA and Executive Programs. He holds a Ph.D. in Managerial Science and Applied Economics from The Economics School of Vienna, Austria, a Master’s degree in Business Administration from IESE Business School, and a BSc in Business Economics from the University of Graz. Professor Liechtenstein specializes in entrepreneurial finance, management of wealth and governance of entrepreneurial families. He is co-author of several publications on private equity. His ongoing research in this field focuses on operational value creation in private equity, impact investing and governance of entrepreneurial families. As a consultant, he collaborates with leading families and financial institutions and serves on the board of family-controlled foundations.

Jonathan Regan

Jonathan Regan is a long-time business partner of John Learmonth, notably as co-director of Campden Publishing where they worked together closely building their offering for family businesses, family offices and their professional advisors. Since exiting Campden after a successful MBO, Jonathan Regan has been involved in several companies, both as a board director and as a consultant and has continued to collaborate with John Learmonth on projects for significant families and investors. He is based near St Albans in the UK.

Kelly McCarthy

For over 20 years Kelly McCarthy has been a business associate of John Learmonth, working with him to develop content and related collateral for a range of audiences. In addition to her work with Deanbridge, Kelly McCarthy owns a publishing business and consults with a range of organisations. Originally Manx, she operates from Alexandria, Virginia and Cape Cod, Massachusetts.

Diego Cobián

Diego Cobián joined the Deanbridge team in 2020 to head its FIC research and data analysis team and is now, in addition, leading a strategy to broaden Deanbridge’s presence in Southern European markets. He is based on Barcelona and previously worked on several research projects with Professor Heinrich Liechtenstein at IESE Business School in areas such as Family Business, Entrepreneurial Finance and Collaborative Philanthropy. Diego Cobián has dual Mexican-Spanish nationality and is also a professionally trained pianist and composer whose works have been premiered in Barcelona and Mexico City.

John Learmonth

The Report is written by John Learmonth who has worked with significant business families for over twenty years. He founded Campden Publishing and built it into a leading, global media group in the areas of healthcare and private wealth management. As part of the latter he organised the first conference in Europe for family offices as well as pioneering its provision of conferences and information for family businesses, FICs, significant private investors and their advisors both in Europe and in Asia. During this time, he worked closely with the Family Business Network (FBN) and many individual country family business associations, serving on the Advisory Council of the UK Institute for Family Business (IFB). Since selling Campden he has been engaged in various projects including participating in turnarounds, advising a merchant bank and a family-owned investment holding company. He is a graduate of Gonville and Caius College, Cambridge.

Professor Heinrich Liechtenstein

The report’s co-author is Heinrich Liechtenstein who is Professor of Financial Management at IESE where he lectures in the MBA and Executive Programs. He holds a Ph.D. in Managerial Science and Applied Economics from The Economics School of Vienna, Austria, a Master’s degree in Business Administration from IESE Business School, and a BSc in Business Economics from the University of Graz. Professor Liechtenstein specializes in entrepreneurial finance, management of wealth and governance of entrepreneurial families. He is co-author of several publications on private equity. His ongoing research in this field focuses on operational value creation in private equity, impact investing and governance of entrepreneurial families. As a consultant, he collaborates with leading families and financial institutions and serves on the board of family-controlled foundations.

Jonathan Regan

Jonathan Regan is a long-time business partner of John Learmonth, notably as co-director of Campden Publishing where they worked together closely building their offering for family businesses, family offices and their professional advisors. Since exiting Campden after a successful MBO, Jonathan Regan has been involved in several companies, both as a board director and as a consultant and has continued to collaborate with John Learmonth on projects for significant families and investors. He is based near St Albans in the UK.

Kelly McCarthy

For over 20 years Kelly McCarthy has been a business associate of John Learmonth, working with him to develop content and related collateral for a range of audiences. In addition to her work with Deanbridge, Kelly McCarthy owns a publishing business and consults with a range of organisations. Originally Manx, she operates from Alexandria, Virginia and Cape Cod, Massachusetts.

Diego Cobian

Diego Cobián joined the Deanbridge in 2020 to head its FIC research and data analysis team and is now, in addition, leading a strategy to broaden Deanbridge’s presence in Southern European markets. He is based on Barcelona and previously worked on several research projects Professor Heinrich Liechtenstein at IESE Business School in areas such as Family Business, Entrepreneurial Finance and Collaborative Philanthropy. Diego Cobián has dual Mexican-Spanish nationality and is also a professionally trained pianist and composer whose works have been premiered in Barcelona and Mexico City.

Targetted Networking

FICs know who they will meet in our community – other families-in-business like them with shared practical business and investment concerns. There are no random walks for subscribers.

APPLY

Subscription details

Subscription to join our community is open to qualifiying families-in-business. For subscription fees and full terms please contact John Learmonth:

or +44 20 7887 2128.

Associate subscription is also available to professional advisors who are either known to Deanbridge or recommended by a community member.

Exclusivity and Confidentiality

Participation in our community is vetted strictly. All events are private and conducted under The Chatham House Rule. Preference will be given to subscriptin applications from families known by our team or introduced to us by trusted sources. Acceptance of subscription applications is at our discretion.

ABOUT

Her Majesty Queen Elizabeth II 1926-2022. We mourn the passing of HM Queen Elizabeth II after 70 years of service, sending our sincere condolences to HM King Charles III and the Royal Family.

COVID-19. At Deanbridge we responded to the pandemic in two practical ways. First, we responded to demands from our community for more, direct personal interaction and knowledge sharing (it can be lonely running a FIC, especially during a crisis) by organising virtual meetings, making introductions and publishing regular news updates showing what their peers were doing. Secondly, we decided to donate a percentage of each subscription we received to a charity or organisation, so far supporting groups such as a national opera company, a community theatre, a local mental health charity, an English animal sanctuary, the Royal National Lifeboat Institute, a crowdfunding appeal for an independent London bookshop and the British Library – like so many at the moment, in our view all in need and all deserving.

The European Family Investment Company Report is published by Deanbridge International (Deanbridge Advisors International Limited), founded by John Learmonth to provide data, intelligence and networking for FICs, family businesses and their advisors.

Deanbridge also provides consultancy services on an assignment basis.

Finally, many people ask why Deanbridge? The Dean Bridge, pictured in our logo and the photographs above, can be found spanning the Water of Leith in Edinburgh. It was one of the last major works by Thomas Telford, the leading civil engineer of his day, completed in 1832. The bridge was commissioned by John Learmonth of Dean, the great great grandfather of John Learmonth, to link Edinburgh’s New Town with the Dean Estate, land he wished to develop as the city expanded to the west.

Photo credit: John Learmonth would like to thank his godson, George Young, for taking the photographs of the Dean Bridge. George is studying at Edinburgh University and, whilst on his permitted daily exercise, took advantage of empty streets during the Coronavirus lockdown to take these photographs in May 2020.

Contact

Deanbridge Advisors International Limited t/a Deanbridge International

85 Great Portland Street, London,

W1W 7LT, United Kingdom.

Telephone: +44 20 7887 2128

Facsimile: +44 20 7887 2129

Email: [email protected]

www.deanbridgeinternational.com